Book Value Per Share (BVPS) is a crucial financial metric that indicates the per-share value of a company’s equity available to common shareholders. It helps investors determine if a stock is overvalued or undervalued based on the company’s actual worth. Many investors use the price-to-book ratio (P/B ratio) to compare a firm’s market capitalization to its book value and locate undervalued companies. This ratio is calculated by dividing the company’s current stock price per share by its book value per share (BVPS).

Everything You Need To Master Financial Modeling

If book value is negative, where a company’s liabilities exceed its assets, this is known as a balance sheet insolvency. When a company’s entire liabilities exceed its total assets, its book value is negative. The Price-to-Book Ratio maintains the connection between the net value of a company’s assets as shown on the balance sheet and the entire value of its outstanding shares. The P/B ratio can also be used for firms with positive book values and negative earnings since negative earnings render price-to-earnings ratios useless. There are fewer companies with negative book values than companies with negative earnings.

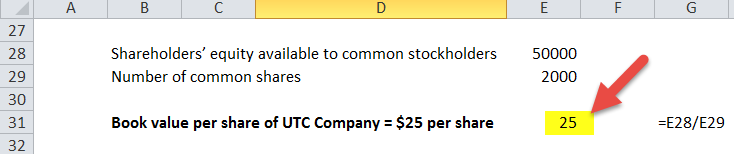

- With those three assumptions, we can calculate the book value of equity as $1.6bn.

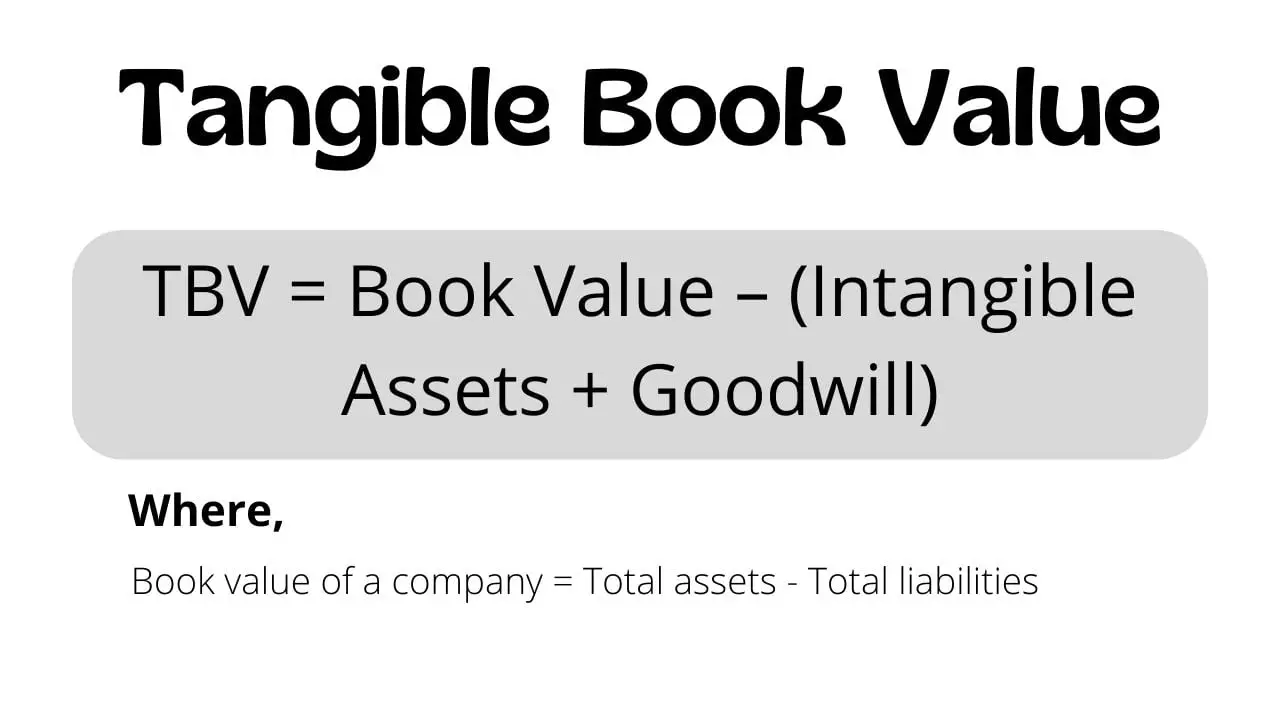

- However, success in the modern business world is frequently linked to a company’s intangible assets including brand recognition, patents, copyrights, and company reputation.

- Therefore, investors typically prefer companies that balance between maintaining high book value and reinvesting for growth.

- It compares a share’s market price to its book value, essentially showing the value given by the market for each dollar of the company’s net worth.

Limitations of Using the Price-to-Book (P/B) Ratio

Investors can use the PB ratio to evaluate if a stock is overpriced or undervalued to its book value. For investors looking for stocks that are trading below their actual value, it’s a useful tool. Market value per share is obtained by looking at the information available on most stock tracking websites. You need to find the company’s balance sheet to obtain total assets, total liabilities, and outstanding shares. Most investment websites display this financial report under a “financials” tab—some show it on a stock’s summary tab.

Best Penny Stocks Under Rs. 10 – Based on Fundamental Factors

The difference between book value per share and market share price is as follows. BVPS is more relevant for asset-heavy companies, such as manufacturing firms, where physical assets constitute a significant portion of the balance sheet. Investors typically view a P/B ratio below 1.0 as an indication of undervaluation. Although the meaning of a “good PB value” differs by how to get an s corp balance sheet to match a tax return industry, some experts consider any value below 3.0 to be favourable. For example, in most cases, companies must expense research and development costs, reducing book value because this includes the expenses on the balance sheet. However, these R&D outlays can create unique production processes for a company or result in new patents that can bring royalty revenues.

It can offer a view of how the market values a particular company’s stock and whether that value is comparable to the BVPS. It approximates the total value shareholders would receive if the company were liquidated. Nevertheless, most companies with expectations to grow and produce profits in the future will have a book value of equity per share lower than their current publicly traded market share price. Often called shareholders equity, the “book value of equity” is an accrual accounting-based metric prepared for bookkeeping purposes and recorded on the balance sheet. BVPS is significant for investors because it offers a snapshot of a company’s net asset value per share. By analyzing BVPS, investors can gain insights into a company’s financial health and intrinsic value, aiding in the assessment of whether a stock is over or undervalued.

What is the relationship between ROE and PB ratio?

In return, the accumulation of earnings could be used to reduce liabilities, which leads to higher book value of equity (and BVPS). If we assume the company has preferred equity of $3mm and a weighted average share count of 4mm, the BVPS is $3.00 (calculated as $15mm less $3mm, divided by 4mm shares). If a company’s share price falls below its BVPS, a corporate raider could make a risk-free profit by buying the company and liquidating it.

The calculation of the book value per share is a relatively simple, straightforward process. It’s a measure of how much each share would be worth if the company were to be liquidated and the proceeds distributed among shareholders. Sandra Habiger is a Chartered Professional Accountant with a Bachelor’s Degree in Business Administration from the University of Washington. Sandra’s areas of focus include advising real estate agents, brokers, and investors. Alongside her accounting practice, Sandra is a Money and Life Coach for women in business.

If a company’s book value per share exceeds its current stock price, the stock is considered undervalued. The stock price will also rise in the market if a company’s share price goes below its book value per share, giving rise to an opportunity for making risk-free profits. But if the stock holds negative book value, then it represents a company’s liabilities are more than its assets, resulting in balance sheet insolvency.