Although infrequent, many value investors will see a book value of equity per share below the market share price as a “buy” signal. But an important point to understand is that these investors view this simply as a sign that the company is potentially undervalued, not that the fundamentals of the company are necessarily strong. The Book Value Per Share (BVPS) is the per-share value of equity on an accrual accounting basis that belongs to the common shareholders of a company. BVPS represents the accounting value of each share based on the company’s equity, while the market value per share is determined by the stock’s current trading price in the market. This formula shows the net asset value available to common shareholders, excluding any preferred equity.

Using Book Value Per Share for Investment Screening

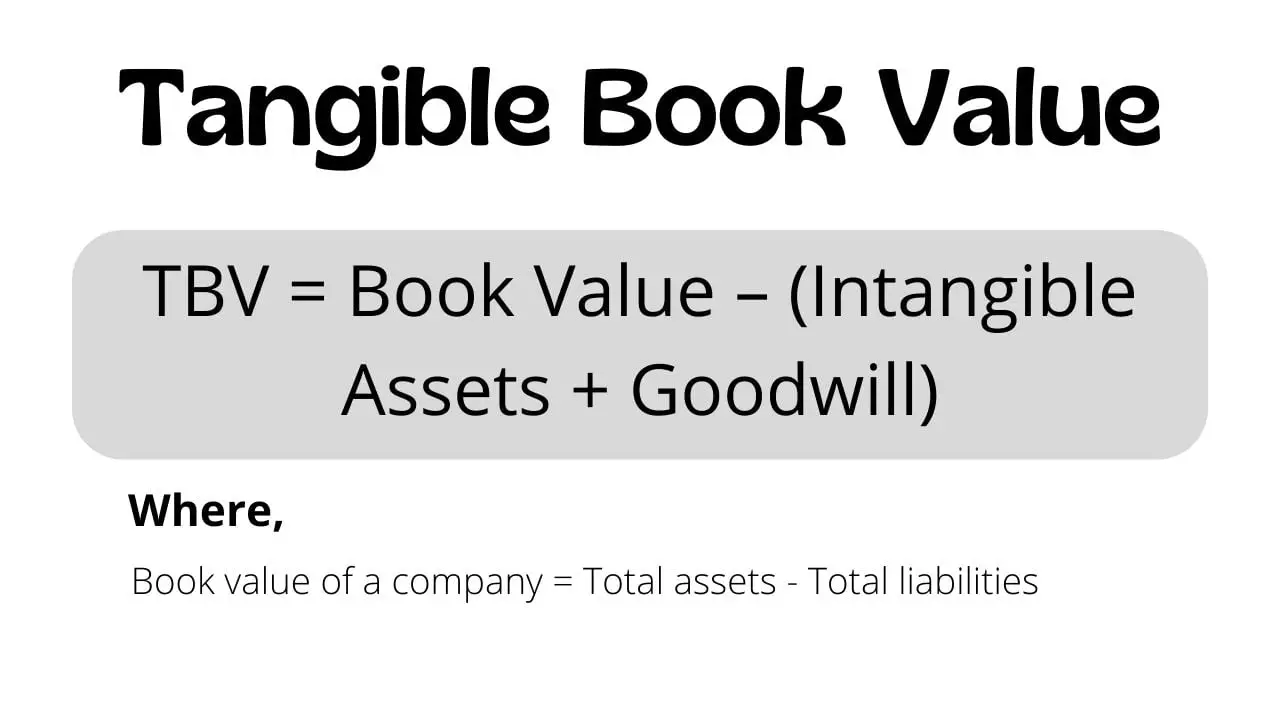

Google, for instance, has an extensive portfolio of intangible assets like its search engine algorithms, customer data, and globally recognized brand, all of which are not reflected in its book value. Therefore, the BVPS for Google will likely undervalue the company if it does not account for these assets. Book value per share holds a significant relationship to a company’s commitment to Corporate Social Responsibility (CSR) and sustainability. It can serve as a key metric to assess a company’s reliable performance in these areas. In the process of M&A, it’s crucial to establish a fair price for the company that is being acquired. The book value per share can assist here by suggesting a baseline for negotiation.

Disregard for Intangible Assets

A company poised to launch an innovative product or tap into a new market might have immense future earnings potential that the BVPS simply does not capture. A high book value per share often indicates that a company has more tangible assets relative to its outstanding shares. This could suggest the company has robust financial health because it owns valuable assets such as property, equipment, or other resources. Book value per share (BVPS) is a measure of value of a company’s common share based on book value of the shareholders’ equity of the company.

Operating Profit Margin: Understanding Corporate Earnings Power

This means that each share of stock would be worth $1 if the company got liquidated. Investors can calculate it easily if they have the balance sheet of a company of interest. Investors can compare BVPS to a stock’s market price to get an idea of whether that stock is overvalued or undervalued. Should the company dissolve, the book value per common share indicates the dollar value remaining for common shareholders after all assets are liquidated and all creditors are paid.

- What counts as a “good” price-to-book ratio will depend on the industry in question and the overall state of valuations in the market.

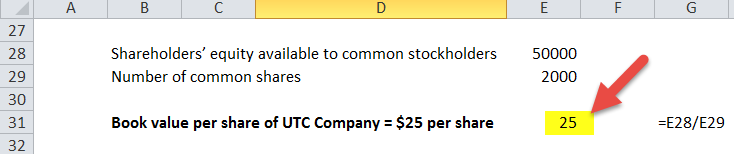

- Therefore, the book value of that company would be calculated as $25 million ($100 million – $75 million).

- The book value per share (BVPS) metric helps investors gauge whether a stock price is undervalued by comparing it to the firm’s market value per share.

- During times of low earnings, a company’s P/B ratio can dive below a value of 1.0.

- Undervalued stock that is trading well below its book value can be an attractive option for some investors.

- This situation suggests a potential buying opportunity, as the market may be undervaluing the company’s actual worth.

Factors Influencing Book Value Per Share

For any of these investments, the NAV is calculated by dividing the total value of all the fund’s securities by the total number of outstanding fund shares. Total annual return is considered by a number of analysts to be a better, more accurate gauge of a mutual fund’s performance, but the NAV is still used as a handy interim evaluation tool. If a company’s BVPS is higher than its market value per share (the current stock price), the stock may be considered undervalued.

Comparison to Market Value Per Share

It is the amount that shareholders would receive if the company dissolves, realizes cash equal to the book value of its assets and pays liabilities at their book value. Because book value per share only considers the book value, it fails to incorporate other intangible factors that may increase the market value of a company’s shares, even upon liquidation. For instance, banks or high-tech software companies often have very little tangible assets relative to their intellectual property and human capital (labor force). While BVPS considers the residual equity per-share for a company’s stock, net asset value, or NAV, is a per-share value calculated for a mutual fund or an exchange-traded fund, or ETF.

By purchasing an undervalued stock, they hope to be rewarded when the market realizes the stock is undervalued and returns its price to where it should be—according to the investor’s analysis. Book value per equity share indicates a firm’s net asset value on a per-share basis. Companies with a low book value could be undervalued, making them potentially attractive for investors seeking profitable investments. These companies might be in a growth phase, reinvesting profits into expansion rather than accumulating assets. For companies seeking to increase their book value of equity per share (BVPS), profitable reinvestments can lead to more cash.

But be sure to remember that the book value per share is not the only metric that you should consider when making an investment decision. There is a difference between outstanding and issued shares, but some companies might refer to outstanding common shares as issued shares in their reports. We’ll assume the trading price in creative accounting definition Year 0 was $20.00, and in Year 2, the market share price increases to $26.00, which is a 30.0% year-over-year increase. The next assumption states that the weighted average of common shares outstanding is 1.4bn. Therefore, value investors typically look for companies that have low price-to-book ratios, among other metrics.